Offering Payment services; strategic choices for banks

Lately, much has been written and presented by banks regarding efforts to upgrade customer value propositions and optimize operating models, and some even identified a need to adapt business models to Open Banking in response to changing industry dynamics. Given the number and scale of the challenges, however, it remains to be seen whether banks' efforts will go far enough to enable them to capture emerging market opportunities and grow the value of their payment’s businesses.

Recently the EBA Open Banking Working Group (OBWG) has published a report titled ‘Ready or not? Gearing the bank operating model towards digital and open banking readiness’. Specifically aimed at those responsible for open banking within their organization, the report supports them on their journey towards future-proof operations – regardless of their starting point.

According to the Payments Journal; Open banking is a gateway to new kinds of payments, but it is still a relatively new concept. Open banking began with the Second Payments Directive (PSD2) and account aggregation. Now banks are working to further innovate beyond the basic requirements and expand into the fintech ecosystem.

At first, many banks limited themselves by only offering APIs within the mandatory scope, seeing the regulations as mere requirements rather than an opportunity to use new technology to innovate and grow. However, with the acceleration of digitization brought on by the global pandemic, banks have been forced to look at open banking with fresh eyes. If banks want to remain relevant in a sea full of fintechs, they need to rethink how they deliver financial services. When working on a new channel or service, it is important to consider how the same thing can be accomplished with an API. This is something big techs have been doing for decades, and now banks too can positively impact the market through data sharing.

This note is based on 1. a published research paper in nov’20 by the European Banking Association and McKinsey & Company. Graphs and subjects are sourced by that paper. 2. EBA publications regarding open banking 3. Publications in the Paymentsjournal

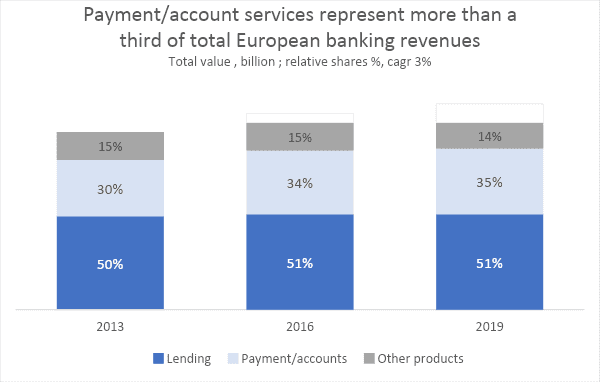

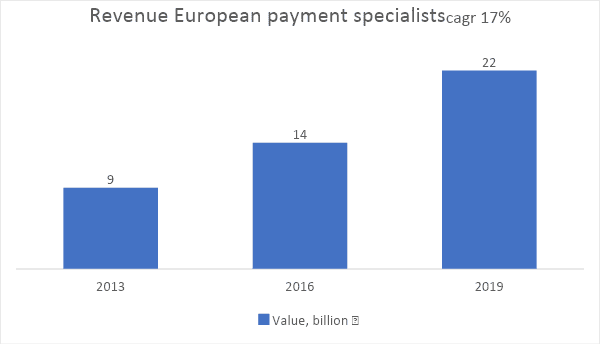

The outlook for the payments sector

In the meantime the stock markets, payments specialists outperformed the overall European banking sector in 2020 and 2021, with a shallower decline and a bigger rebound. Banks continue to be affected by mounting credit losses and low interest rates; payments specialists stand to gain from the shift to digital commerce and electronic payments; fintechs have opportunities to target a broader pool of customers and capitalise on their cost advantages but are more exposed due to their market and service focus; bigtech have the means to invest but are under increased scrutiny from governments and regulators.

Source S&P capital IQ company financial statements; McKinsey

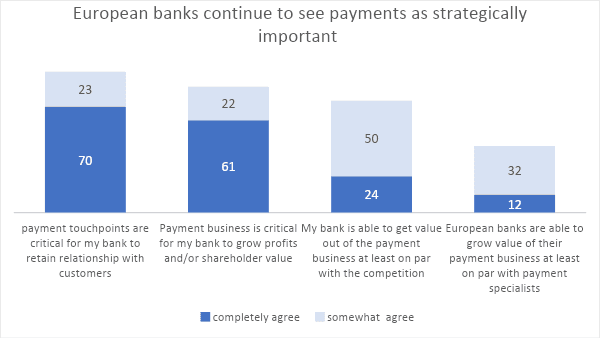

Most banks though aspire to lead in at least one customer segment. But recent trends have accelerated the shift to digital, reshaped customer behaviour, and increased the pressure on bank’s traditional position in the payments business. The coming period could bring opportunities to regain ground in their stronghold of payments - or the prospect of losing share to a growing number of competitors providing a wide range of each niche payment services to consumers and business.

Source 1 Survey of EBA members in 2020

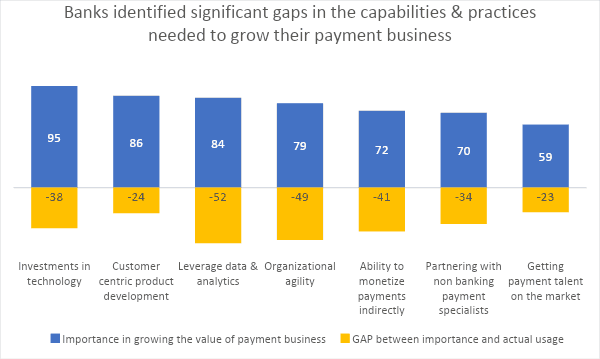

All these opportunities and innovations are tech driven, and therein lies a challenge. Unlike financial resources, tech resources are scarce. Access to tech. resources including the culture to match is therefore a prerequisite. Add to that payment domain knowledge and experience and the scarcity will only increase, banks are therefore competing not only with payment specialists for market share but also for access to these scarce resources.

To support the banks with these challenges, the above mentioned ‘Ready or not?’ report addresses both the general implications of digital readiness and the specific requirements for the successful implementation of open banking at the operating model level. It is designed to provide a reference point when transforming the operating model and to help the people responsible to execute their open banking strategy in the emerging digital environment.

Challenged by the changing environment, different banks are pursuing different strategies to achieve digital readiness. The report identifies five common underlying design principles for future-proof banking operations: Customer-focused; embedding products and services at point of relevance for the customer Data-driven; expanding data availability with consumption of external data sources Openness-oriented; allowing interaction with third parties and ecosystems Technology-enabled; supporting state-of-the-art API infrastructure Adaptive to change; increasing flexibility and reducing the time to market for new propositions The report explains how the design principles can be applied in practice to all aspects of a bank’s operations, right down to activity level. An abstract of the paper is available to everyone on the EBA website.

Takeaway

Banks are facing, and will continue to face, some serious competition from fintechs and other banks in the payment services domain. To remain relevant during a time of technological revolution, they must position themselves for open banking in a way that holds rank with their competitors. The approach to innovation will be unique to each institution, and banks must decide where their strengths are in the broader ecosystem. If they fail to do this, they face the risk of harming their profitability as traditional revenue streams decline. With open banking, financial institutions can offer a variety of alternative sources of revenue to both retailers and SMEs.

One of the conclusions is that in all three cases, a certain degree of cooperation with fintech or tech companies is crucial, Banks have a range of opportunities to collaborate with these companies to fill capability gaps, drive economies of scale, mitigate investment risk, reduce the complexity of providing non-differentiating activities, and help set new market standards. Most banks believe that cooperation is extremely important and were willing to pursue collaborations in the future.

Source : survey of EBA member, Q1 2020

Ximedes is happy to join this effort and is willing to support banks in their payment strategy.

If only in view of the above-mentioned challenge concerning these scarce tech payment resources Ximedes could support, but together we can build offerings that banks were previously incapable of bringing to market.

For instance, the roadmap to open API enablement. Yes, we know that some degree of back-office reinvention is necessary to take full advantage of front-office, open APIs. But how are you as a bank supposed to get there? APIs are a challenge to the traditional structural approach, so banks need to carefully consider their courses of action before making any decisions. There is always the risk of putting extra strain on an already complex payment silo landscape.

There are two questions you should ask yourselves before implementing any new technologies: can the bank adapt their current channel, middleware, and back-office systems to the demands of open API access? Do we need a completely new approach? The answers to these questions will help you as a bank to determine your goals, challenges, and advantages.

Suppose you are a bank, your strategy around payment systems is clear but the ability to execute is hindered by a lack of fintech competences or scale, come and talk to Ximedes, our insights always help, as several national and international banks have already experienced.

For this purpose, Ximedes offers 110 highly qualified employees with a specialization in quality driven software development in payment solutions. In addition, Ximedes develops on its own initiative and at its own cost software components to be used in various transaction systems.

Want to know more? Feel free to reach out to us at info@ximedes.com

Ready to Transform your Business with Little Effort Using Vertical?

René Hodde

René Hodde