Europen Merchant Services

A seamless boarding experience

Introduction

EMS

European Merchant Services (EMS) provides payment solutions and services to businesses across Europe. EMS specializes in offering merchant services, including payment processing, card acquiring, and other financial services for merchants.

EMS is part of Fiserv and focuses on the Benelux market. In 2017 EMS asked Ximedes to help them develop a new, seamless boarding experience for their merchants. In the years after that we also developed a merchant portal, self service funtionality and together with our sister company Ginger Payments we added online payments to EMS' arsenal.

The Challenge

A seamless boarding experience

A few years back, EMS realised that it was pivotal to make their onboarding experience seamless and efficient. A fast, first-time-right boarding experience makes it much more likely that merchants who like EMS offering actually become a customer. EMS also knew a well-orchestrated boarding flow was the only thing that could keep the headcount in the KYC department in check.

The process EMS had that time was part paper, part digital, and many different boarding flows existed, depending on the country, the payment terminals selected and the type of contract. Ximedes and EMS designed an efficient, digital process and only a few months later the first fully digital boarding flow was live. It features a merchant boarding portal that guides merchants through AML information gathering and allows them to specify terminal needs and preferred online payment methods in one streamlined process.

The new boarding solution decreased the time it took for a merchant to become a customer from two weeks to well under a day.

.png)

Background

AML Legislation in Europe

The first AML directive in the EU came into effect in 1991. The Fourth Anti-Money Laundering Directive (AMLD4) came into force on June 26, 2017. It was a significant step in enhancing the EU's AML and counter-terrorist financing framework, introducing more stringent measures for customer due diligence, beneficial ownership transparency, and information sharing among member states.

From than on, financial institutions had to perform a client due diligence (CDD) process to identify new customers. From the first moment, EMS used the boarding tool to perform the following steps to comply with the AML directive.

1. A merchant is identified and looked up in a separate source based on Chamber of Commerce data.

2. The signatories of the company are identified by the same means, their role confirmed during the boarding process. The identity of the signatories validated in a completely digital way.

3. The UBOs of the merchant are identified.

Solution

Risk Assesment

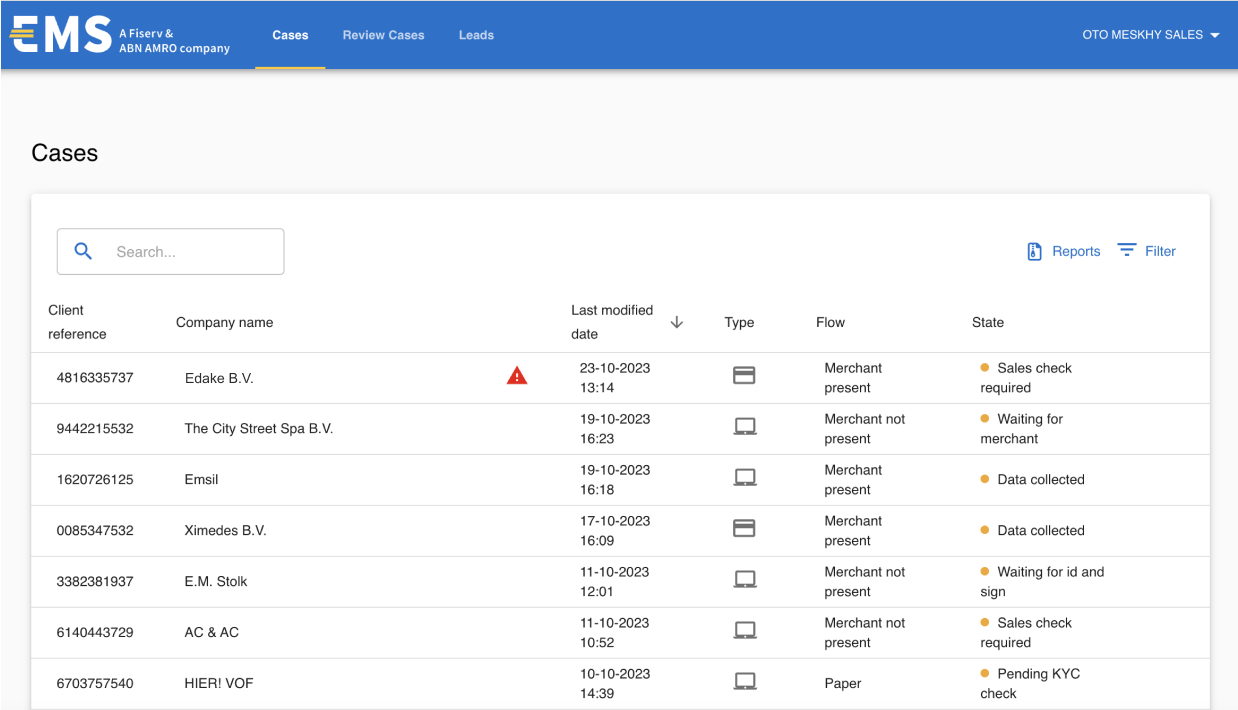

Apart from the merchant boarding portal, EMS and Ximedes developed a backend portal that shows all boarding processes that are currently active. EMS sales force use this tool to help merchants fill out information if they missed something, or if an identity check against their passport or identity card failed.

The backend portal provides visibility into stalled onboarding processes, enabling sales personnel to proactively assist merchants with their onboarding process.

Risk Officers use the backoffice portal to perform a risk assessment on the customer once the boarding data is complete. Out tools help them do so by scoring the customer against a range of dimensions including PEP- and Sanction List checks, MCC codes and UBO residency.

Key results

Periodic reviews

The AML directives require financial institutes such as EMS to perform a review of customer data. The frequency of these checks are dictated by the risk assessment of the customer. Low-risk merchants are checked every feew years, high-risk customers are checked more frequently and more thoroughly.

The toolset we built supports periodic checks, taking the original customer data as a basis, the merchant is rechecked, including the signatories and UBO's that may have changed.

OUR MISSION

Merchant Self-Service

EMS has long-term relationships with their merchants and during that period these clients grow and prosper. They open a new outlet that requires two payment terminals, they move to a new address or they want to be paid out on a different IBAN number.

EMS enables many of these updates through self-service. This benefits clients by providing control over changes and enhances EMS's efficiency by reducing the need for extensive back-office staff.

However, certain changes, like modifying an IBAN number, necessitate a partial AML check to verify the legitimacy of the merchant and the new details.

Our modular onboarding tool allows for sequential AML/KYC checks, similar to the initial onboarding process, for case-specific checks when utilized in self-service actions.

.png?width=2000&height=1333&name=Embedded%20Payment%20Page%20(1).png)