The Fabric of Fintech

Ximedes designs, develops and runs payment platforms for financial institutions.

Our software allows financial institutions to provide their customers with modern, omni-channel and seamless payment services for terminal payments, online payments and digital onboarding.

Helping banks to become fintechs

Banks are the natural partner for merchants when it comes to payments. Yet neo-banks and payment specialists have been able to attract many customers away from their banks, using digitalisation to offer superior onboarding, merchant portals, ease of integration and an extensive range of services that go far beyond the basics. Ximedes helps banks to become competitive again through building payment services that are deeply integrated with core banking platforms, while offering the agility and flexibility of modern PSPs.

Highlighted Service: Enabling Instant SCT

In February 2024, the Council of the EU adopted a new regulation mandating the full availability of instant payments to consumers and businesses across the EU and EEA countries. By January 9, 2025, all banks offering current accounts must be able to accept incoming instant payments. By October 2025, they must also support outbound instant payments. To comply with the Instant SEPA Credit Transfer (SCT) standard, these payments must be processed within 10 seconds and available 24/7.

01

Online Payments

Twenty years ago we developed our first online gateway for ecommerce payments for Dutch banks, and we haven't stopped since. We can integrate any alternative payment method and create APIs, portals and plugins that your merchants love to use.

02

Terminal Payments

We have extensive experience in building EMV payment gateways - reliable, secure, and audited under the strict regulations of EMVCo and PCI-DSS. We seamlessly integrate any payment terminal and any acquirer with your payment platform.

03

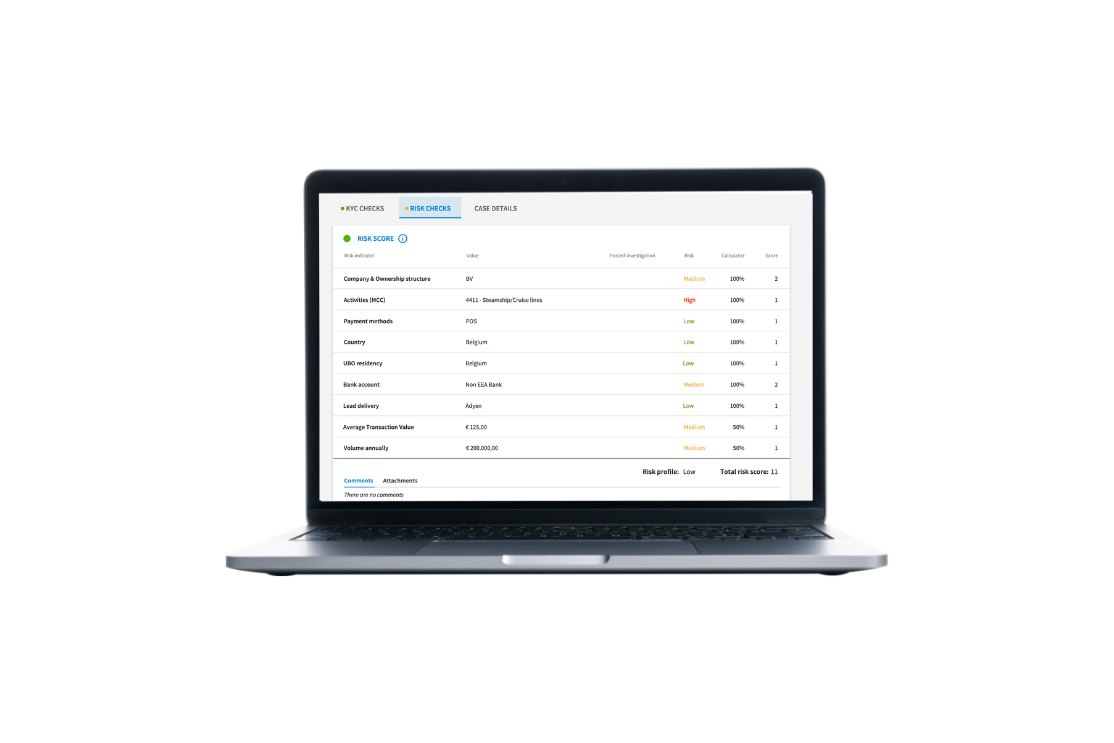

Merchant Onboarding

KYC, AML, PEP - the rules and regulations surrounding merchant onboarding and transaction monitoring force financial institutions to invest in efficient processes and powerful software. Ximedes helps the best brands with their onboarding challenges.

04

Embedded Payments

Embedded payments are payments directly integrated into a website or application, without the need to visit a separate payment page.

05

Reconciliation & Settlement

Reconciliation and settlement processes ensure you and your merchants are aware of all transactions and that the funds are transferred correctly and securely.

06

Verification of Payee

Instant payments are great as they improve the liquidity of business, but the risk of fraud increases. An important measure to combat fraud: Verification of Payee (VoP).

///////

Product Portfolio

Merchant Onboarding

"Ximedes helped us design and build a KYC solution that decreased onboarding times from weeks to hours."

Joachim Goyvaerts

CEO

Terminal Payments

"Ximedes designed and developed a fast and secure terminal gateway for Loomis Pay."

Micheal Pickett

COO

Merchant Dashboard

"Our Merchant Portal contains billions of records, yet it displays complicated data in milliseconds."

Bart Wiezer

Product owner Cards Acquiring

Personal Note

How design can make or break a product's success

When it comes to empathizing with users, innovative design solutions are the key. Think about it: the more intuitive and seamless the design, the more effortlessly users can navigate the payment process. This not only creates a more positive user experience, but also builds trust and loyalty between users and the brand. So if you want to make an impact in the world of smart payments, it's time to start thinking outside the box and exploring new and innovative design solutions.

Gijs ter Horst

CCO