Online Payments

From our first ecommerce gateway for Dutch banks to today’s seamless APIs, portals, and plugins, our solutions make it easy to integrate any payment method your merchants need.

A Strategic Edge for Banks

Empower Merchants to Own the Online Payment Experience

Payments: The Heartbeat of Modern Banking

Europe’s B2C e-commerce market is surging at €899 billion and climbing at 8% annually. Online payments are the lifeblood of this digital economy. While names like Adyen and Stripe dominate headlines, the field is wide open for ambitious banks ready to claim their stake. Payments aren’t just another service-they’re central to banking strategy. That’s why leading banks trust Ximedes to deliver the technical backbone for their merchant payment ambitions.

How Banks Enable Online Payments

Banks are transforming from payment facilitators to strategic commerce enablers, protecting revenue streams while deepening merchant relationships in an increasingly competitive market.

Payments: The Heartbeat of Modern Banking

For decades, banks have been the architects of account-to-account payments. Recent Ximedes research shows payments and account services drive 35% of European banking revenues, echoing findings from McKinsey and the EBA. But the value goes deeper. By offering merchant services, banks unlock powerful customer insights-fuel for smarter cross-selling, sharper fraud prevention, and innovative products like revenue-based lending.

Client Retention in a Disrupted Landscape

Today’s merchants demand more than basic transactions. They need to offer a fast-evolving mix of payment methods to stay competitive. Full-spectrum merchant services aren’t a luxury, they’re a necessity for retaining clients. With PSPs like Stripe and Adyen moving into traditional banking territory, banks risk losing merchant relationships unless they act decisively.

How Online Payments

Work in Europe

The Infrastructure Powering Digital Commerce

Account-to-Account Payments

SEPA (Single Euro Payments Area) sets the standard for seamless domestic and cross-border transfers within the Eurozone. SEPA Credit Transfers (SCT) and instant payments (SCT Inst) ensure funds move swiftly, often within seconds. For recurring payments, SEPA Direct Debits (SDDs) offer merchants reliable, automated collection.

Card Payments

Cards remain the workhorse of both in-store and online payments. Transactions flow through a complex network: the merchant’s acquiring bank seeks authorisation from the customer’s issuing bank, all governed by global schemes like Mastercard and Visa. These schemes dictate everything from technical protocols to pricing.

Alternative Payment Methods

Beyond cards and SEPA, a new wave of payment options: Buy Now Pay Later, digital wallets like PayPal, and Request-to-Pay are reshaping the landscape. Many, like iDEAL or Bizum, cleverly leverage SEPA rails or card infrastructure to deliver local relevance and convenience.

How Banks Enable Merchant Payments

Banks bridge the gap between complex payment networks and merchant needs through strategic partnerships and technology platforms, transforming technical barriers into business opportunities.

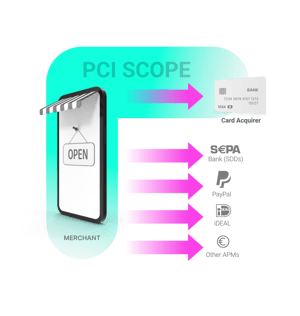

Direct integration with banks, card acquirers, and alternative payment methods is a technical and compliance minefield, manageable only for the most prominent merchants. Security standards like PCI-DSS add further complexity.

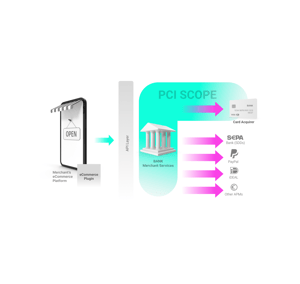

PSPs simplify the chaos. Their online payment gateways offer a single API, connecting merchants to various payment methods. Integration is streamlined, documentation is robust, and developer support is built-in, enabling merchants to launch quickly and scale confidently.

Most merchants rely on platforms like WooCommerce, Magento, or Shopify. PSPs provide ready-made plugins, letting merchants go live in minutes- a critical advantage, especially for SMES.

Handling card data directly exposes merchants to significant compliance risk. PSPs mitigate this by offering Hosted Payment Pages, where sensitive data bypasses the merchant’s systems entirely. For those seeking a more seamless checkout, JavaScript libraries enable direct integration, trading convenience for a higher compliance bar.

Distributing PSPs route funds directly from payment networks to merchants. Collecting PSPs aggregate funds and handle settlement, delivering unified reporting and reconciliation across all payment types.

Merchant portals are the operational hub for tracking transactions, settlements, and services. They also streamline onboarding and compliance, letting merchants complete KYC requirements online. For PSPs supporting in-store and online payments, unified omnichannel reporting is essential.

Why Ximedes?

For over two decades, we have been at the forefront of payment innovation, pioneering solutions that power leading financial institutions across Europe.

Ximedes has been shaping the future of payments with ING since 2002, building one of the Netherlands’ first digital payment platforms. Today, we’re the trusted partner behind Rabobank’s payment infrastructure and many more. From terminal gateways to reconciliation engines, our expertise covers every layer of the payments stack. Ready to future-proof your payment offering?