Enabling Instant SCT

When your core banking systems don't support it

Instant payments to be made available

Instant payments to be made available

In February 2024, the Council of the EU adopted a new regulation mandating the full availability of instant payments to consumers and businesses across the EU and EEA countries. By January 9, 2025, all banks offering current accounts must be able to accept incoming instant payments. By October 2025, they must also support outbound instant payments. To comply with the Instant SEPA Credit Transfer (SCT) standard, these payments must be processed within 10 seconds and available 24/7.

Transitioning from batch-oriented payments to real-time payments presents significant challenges, even with a modern IT infrastructure. But what if your IT landscape or core banking system cannot meet the stringent real-time requirements or the need for uninterrupted availability?

In such cases, Ximedes can provide a solution. In collaboration with TietoEvry, we have developed an Instant SCT component designed to operate continuously, handle thousands of transactions per second, and seamlessly integrate with legacy back-office and core banking systems.

I want information about Ximedes' Instant SCT solutions

Combat fraud

Instant SCT payments

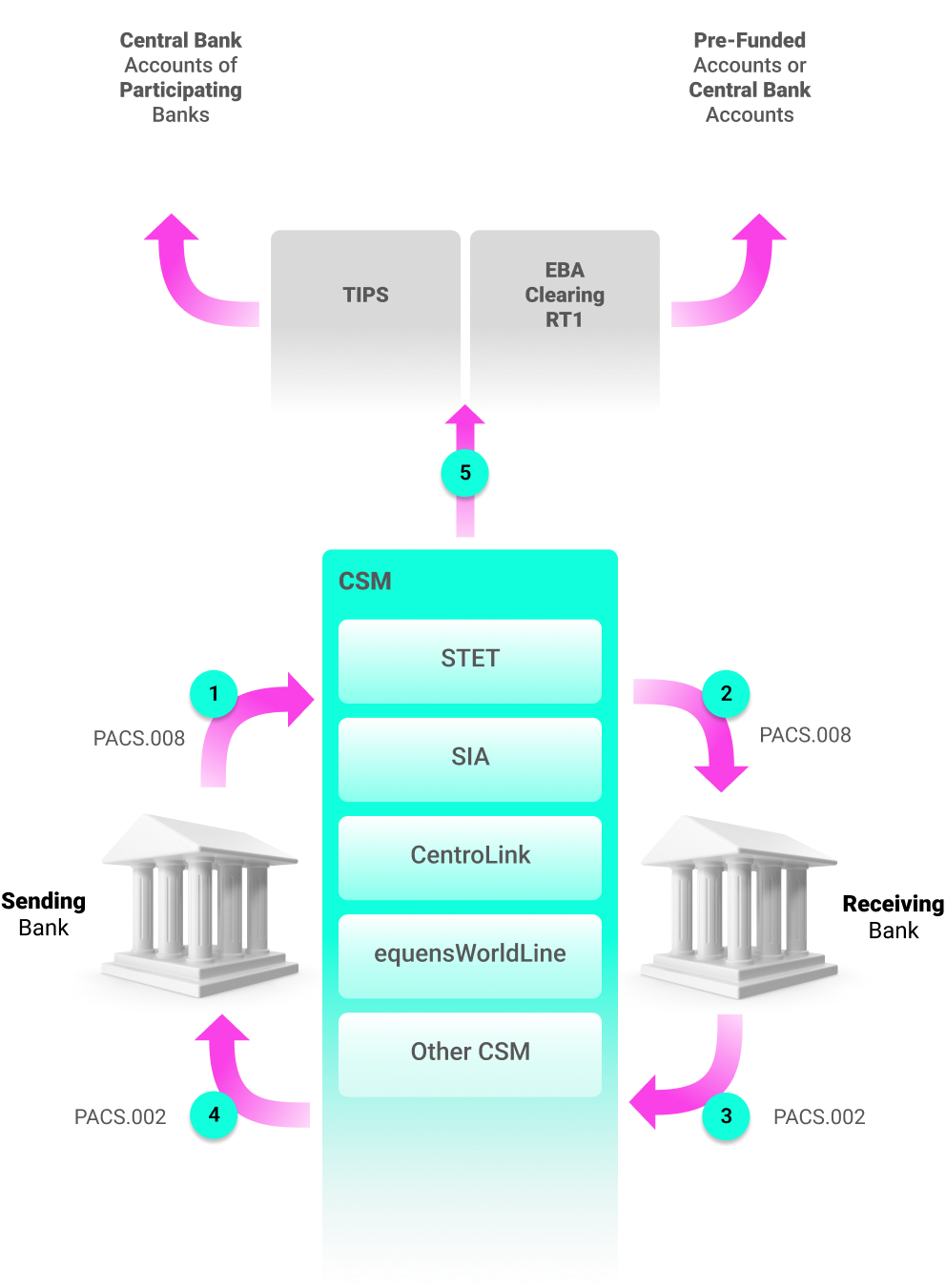

To initiate an instant payment, the sending bank sends a PACS.008 message to the receiving bank. This doesn't happen directly, but via a Clearing and Settlement Mechanism (CSM), as depicted in the picture on the right.

The CSM checks the syntax and validity of the message, and forwards it to the receiving bank.

The receiving bank handles the PACS.008 message, and when everything is checks, out they return a PACS.002 message acknowledging that the payment succeeded. The PACS.002 is response goes back to the CSM, who passes is on to the sending bank.

Upon receiving the PACS.002, the sending bank executes the payment.

The CSM then performs a Real-Time Gros Settlement (RTGS). It does so, by sending a settlement message to either TIPS (Target 2) or EBA Clearing RT1. Both have a slightly different way of managing the funds for banks. TIPS holds accounts at the central bank. EBA can do that, but it also provides the option of pre-funded positions. So the funds of banks are also moved in real-time, in step with the instant SCTs!

Note: The PACS messages are ISO20022 messages, defined as part of the SEPA standard. PACS.008 is a Credit Transfer Message, used to initiate a payment. PACS.002 is the Payment Status Report.

Receiving Instant Payments

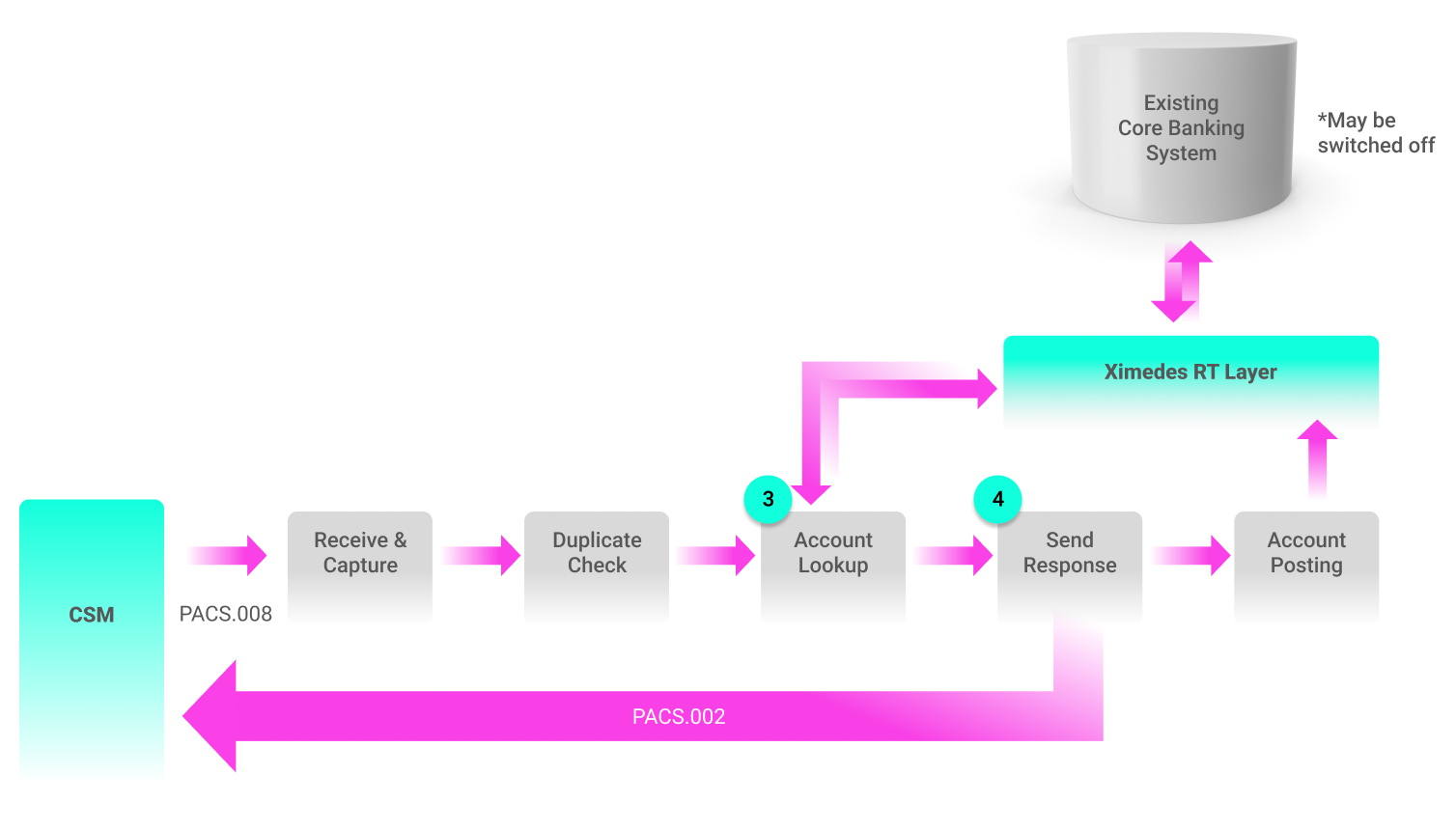

As a bank, you receive an instant payment message from a CSM when money is transferred from another bank to an account at your bank.

The account on your side will then be credited, and as the available funds of the the account on your side will rise, no checks on the balance are necessary.

The steps that you need to take as the receiving bank are:

- Validate the incoming pacs.008 message, making sure it is well-formed and correct.

- Make sure that this payment initiation isn't a duplicate of one that has been processed before.

- Check existence and suitability of the target account.

- Send a pacs.002 with the payment status back to the CSM.

- Post the beneficiary account, so it's balance is increased by the correct amount.

Initiating an SCT

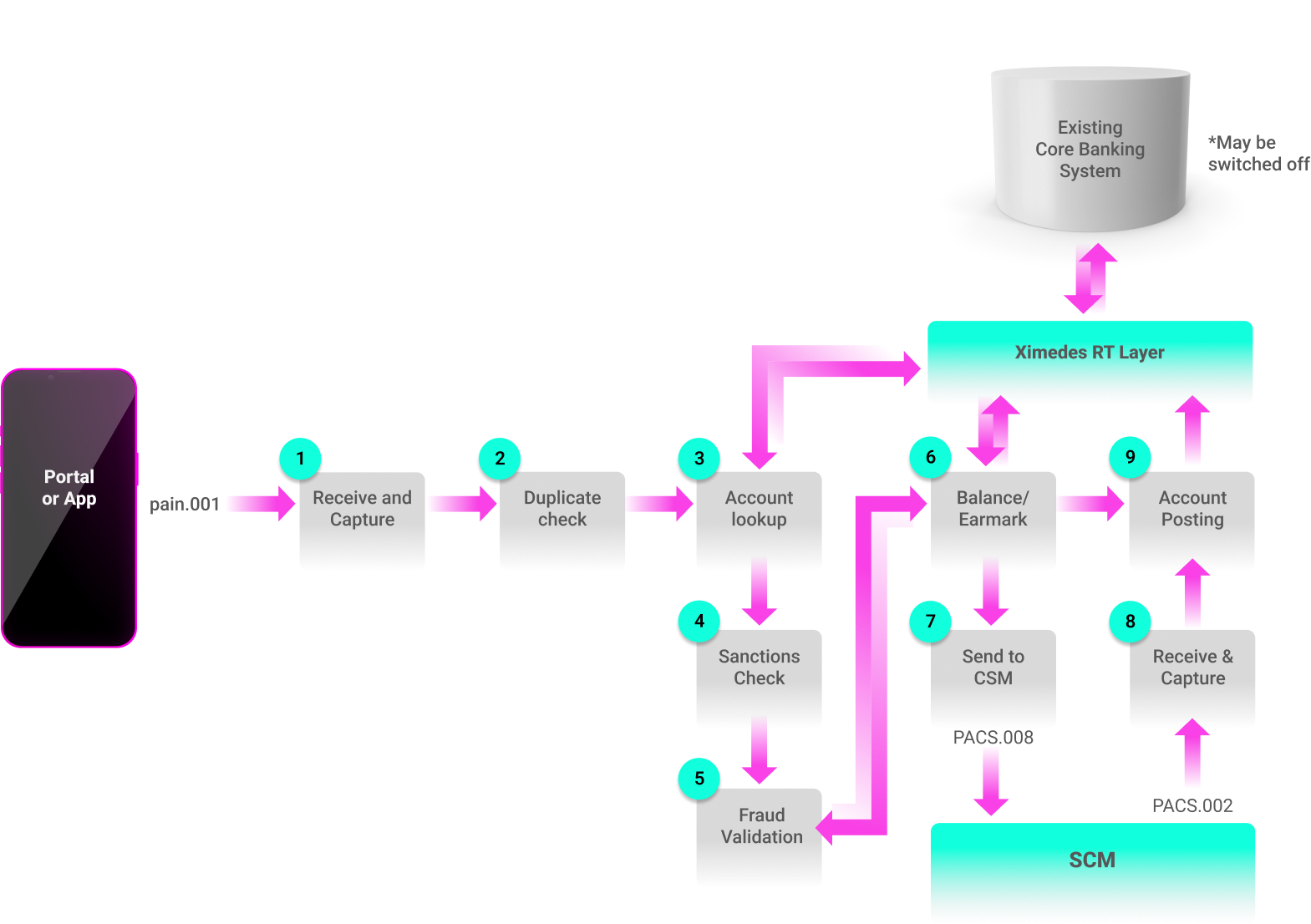

The initiation of an SCT starts at an accountholder. Typically, she would log in to het banking App or portal, and enter an name and IBAN of the person she wants to send money to.

This would generate a PAIN.001 message that will be sent to the payment systems of the bank. Initiating a payment involves a few more steps than receiving an SCT. The balance must be checked, and some anti-fraud measures must be taken.

- The pain.001 message is checked for correctness and completeness.

- It is made sure that this message wasn't processed before.

- The account - including account holder data - is looked up, and

- A PEP and Sanction List check is carried out, for the account holder.

- Fraud validation is carried out.

- The transaction is prepared by earmarking the amount that needs to be transferred. A check is carried out to make sure the balance of the account holder is sufficient. If that all checks out, a pacs.008 is sent to the CSM.

- The system then waits for the corresponding pacs.002 to return from the CSM, acknowledging that the money was correctly transferred. Upon reception of the message, the earmarked amount is posted and the transaction is complete.

OUR solution

How Ximedes helps processing instant payments

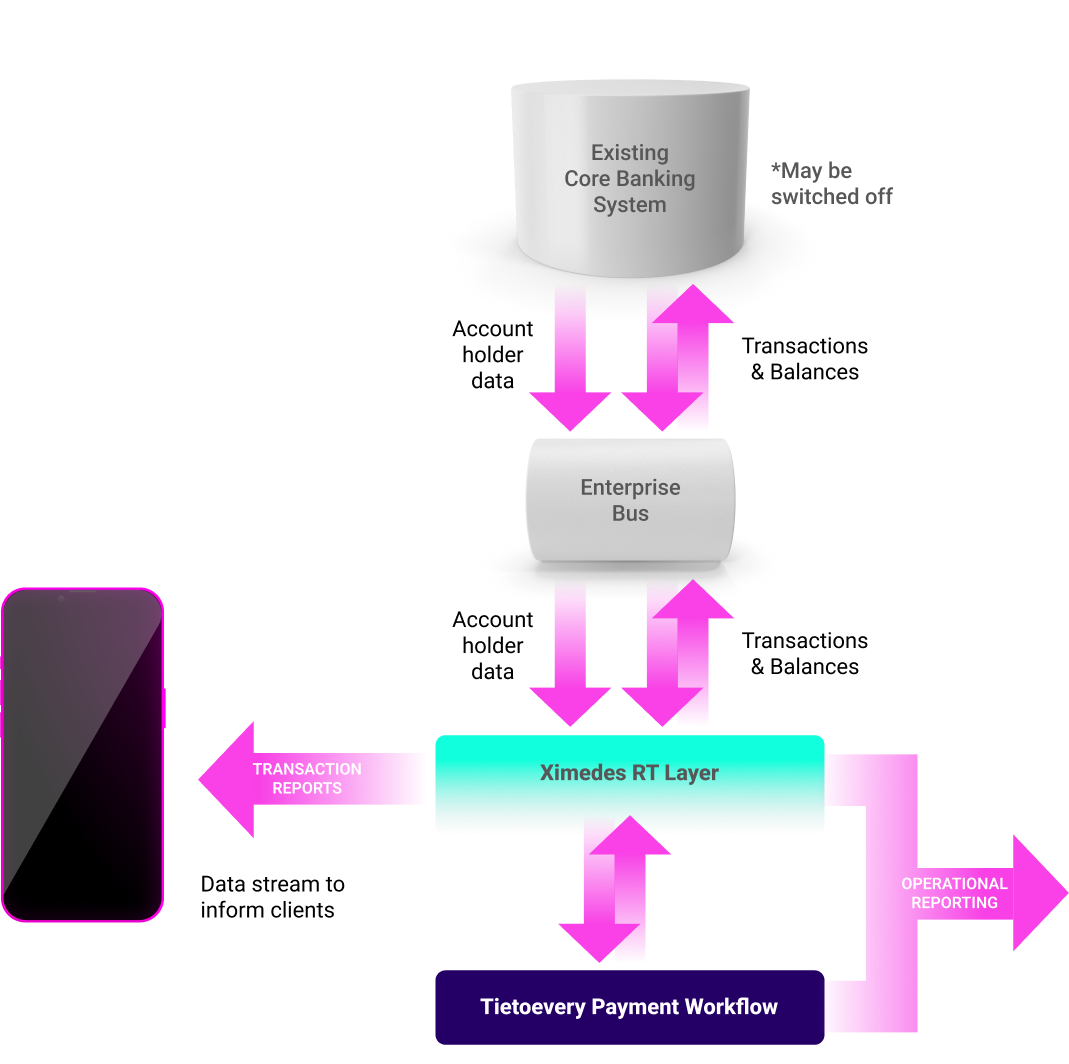

TietoEvry and Ximedes came up with a unique way to help financial institutions to comply with the "Regulation on Instant Payments in Euro".

Even when your current Core Banking system, or other parts of the infrastructure can't handle instant payments 24/7, we can add our RT layer that does this for you.

From Ximedes RT Layer, we make connections to pre-existing systems in your IT landscape, so that they are kept up to date, at their own pace. Of course, payments processed by the RT Layer must also be connected with real-time reporting systems that informs you clients in their Apps or Web Portals about the transactions that took place.

TietoEvry has off-the-shelf solutions that manage the workflow of a payment, as depicted in the figures to the right.

Feel free to contact us if you want to discuss our solutions further.