On March 27th, Ximedes organized their first roundtable event of the year on the topic ‘Embedded Finance’ at Meet Berlage in Amsterdam. We invited industry leaders that deal with Embedded Finance to participate in our roundtable event. For this edition we thought it would be interesting to approach the topic from three different perspectives as embedded finance is a broad term and has a lot of impact on the current market. We decided to invite Joris Hoekstra, Head of Rabobank's Banking-as-a-Service team; Ward Hagenaar, Co-owner at PaymentGenes together with Kirsten Hoornstra; Ari Cormam & Wout Molenar from Jifiti and our own Joris Portegies Zwart, CEO of Ximedes to present on this topic.

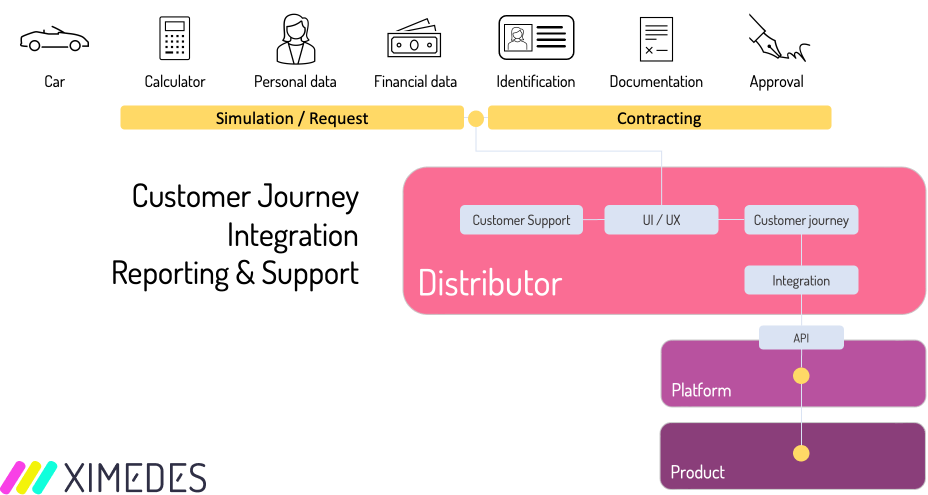

Joris Portegies Zwart, the CEO of Ximedes, led a roundtable about the technical aspects of implementing embedded finance products, such as APIs, scalability and custom integration. Joris spoke about how an integration-first, or top-down approach to product design, is crucial to delivering products that fit seamlessly into the customer journey of non-financial parties.

Our first guest speaker was Joris Hoekstra, the head of Rabobank’s Banking-as-a-service team who talked about what embedded finance means for traditional banks and examples of applications. He talked about the benefits of partnerships with embedded finance, think of companies like bol.com.

Our first guest speaker was Joris Hoekstra, the head of Rabobank’s Banking-as-a-service team who talked about what embedded finance means for traditional banks and examples of applications. He talked about the benefits of partnerships with embedded finance, think of companies like bol.com.

Our second guest speaker was Ward Hagenaar from PaymentGenes together with his colleague Kirsten Hoornstra. They came to talk about practical examples of embedded finance within the industry and if Embedded Finance is a hype or a logical evolution. Besides examples they also presented how the breakthrough of embedded finance shows similarities with retail, payments and finance development steps. If you like to learn more about the PaymentGenes presentation, click here.

PaymentGenes also invited Jifiti to talk about Embedded Lending. Jifiti has a white-labeled platform where banks and lenders embed their loans at any point of sale while merchants access the business and consumer loan programs. This way the merchant and lender maintain a direct relationship where Jifiti just facilitates the solution. This presentation was very interesting for the banks and merchants that were present. They concluded their presentation with some statements and discussion topics that ensured the guests were interactive during the discussio After the round table sessions, participants enjoyed networking while enjoying drinks and snacks, giving guests the opportunity to engage in conversation with industry peers to build new relationships. We would like to sincerely thank all participants for contributing to the success of this event and hope to host you at a future edition as well.

After the round table sessions, participants enjoyed networking while enjoying drinks and snacks, giving guests the opportunity to engage in conversation with industry peers to build new relationships. We would like to sincerely thank all participants for contributing to the success of this event and hope to host you at a future edition as well.

If you couldn't make it this time, stay tuned for updates on future roundtable sessions via our LinkedIn or our event page.