Embedded Payments

Transform the way your customers pay. Ximedes empowers banks and PSPs to deliver frictionless, invisible payments that elevate every digital experience. From the first tap to the final transaction, we make seamless commerce the new standard.

Embedded Payments: The New Consumer Standard

Embedded Payments: The New Consumer Standard

Today’s consumers expect payments to disappear into the background. Embedded payments do just that-integrating so tightly with the user journey, the transaction becomes almost invisible. Think Uber: you step out of the car, and the fare is settled with extra steps, no awkward handoffs. Amazon’s “one-click” checkout pioneered this shift, making shopping effortless and boosting conversion rates.

The Ximedes Contribution

Banks and PSPs can unlock this level of convenience for their merchants by offering tokenization services on their behalf. Ximedes shows you how to become an On Behalf Of Tokenization provider-helping your merchants win more business with every seamless payment.

Why Embedded Payments Matter

In today's digital landscape, the most successful merchants make payments invisible—seamlessly woven into the customer experience rather than interrupting it.

Frictionless Journey

Every extra click is a lost customer. Embedded payments remove barriers, letting users pay without ever leaving the app or site. The result? Higher conversion, happier customers, and a checkout flow that feels almost magical.

Customer Loyalty

Convenience breeds engagement. By making payments effortless, merchants invite more frequent interactions and build lasting relationships. Embedded payments turn transactions into touchpoints for loyalty.

Precision and Speed

Manual entry and payment errors are relics of the past. Integrated payments automate the process, reducing mistakes and saving time for both customers and businesses.

Actionable Insights

Every transaction tells a story. Embedded payments generate rich data, giving merchants a window into customer behaviour. Leverage these insights for smarter decisions and personalized offers that keep customers coming back.

The Technology Behind Embedded Payments

Modern embedded payments rely on sophisticated security architecture that makes transactions both seamless and safe—here's the technology that makes it possible.

Card-on-File: The Foundation

Storing card details securely used to be the only way to enable embedded payments. Customers entered their information once; merchants kept it in a PCI-compliant vault. When it was time to pay, the app retrieved the data needed to re-enter details, with no friction. But with great power came great responsibility: storing sensitive data meant high-security stakes.

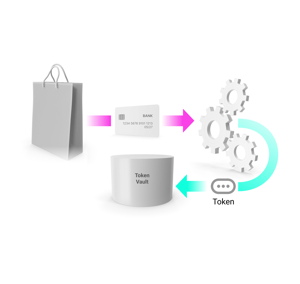

Tokenization: The Game Changer

Enter tokenization. Now, instead of storing real card data, merchants use tokens-secure substitutes generated by card networks like Mastercard and VISA. These network tokens are unique: only the merchant who created the token can use it, rendering stolen tokens useless to fraudsters.

Tokenization delivers security without sacrificing convenience. Merchants can initiate payments with tokens just as they would with card data, but with dramatically reduced risk.

How Banks and PSPs Can Lead

The embedded payments revolution belongs to those who make it accessible—banks and PSPs that transform complex tokenization into simple, secure services for every merchant.

Democratizing Embedded Payments

Tech giants like Uber and Amazon have the resources to build their tokenization stacks. Smaller merchants don’t. Banks and PSPs can level the playing field by offering tokenization as a service-handling the complexity, compliance, and cost.

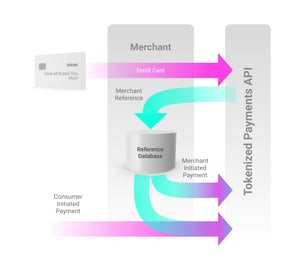

All merchants need to do is connect, submit card details, and receive a token or reference. No PCI headaches. No risk. Tokens remain valid even if the card expires. Merchants control when payments are triggered-subscriptions, pay-now buttons, and proximity events. The payment flow becomes theirs to design.

Tokenization services let merchants embed payments anywhere in their customer journey, delivering the seamless experience today’s consumers demand.

Ximedes: Your Partner in Embedded Payments

Ready to become a token service? Ximedes builds the infrastructure banks and PSPs need to empower merchants with seamless, secure payments.

We help you launch APIs that accept card details and return tokens-ideally on bank-hosted pages to minimize PCI exposure. Our solutions handle the behind-the-scenes calls to Mastercard and VISA, returning tokens or references that merchants can safely store.

When it’s time to pay, your API takes the token or reference and initiates the transaction-whether it’s a recurring subscription or a single click. Ximedes ensures your platform is PCI-DSS compliant and ready for card brand certification.

Secure Remote Commerce: Click-to-Pay

Click-to-Pay is the next evolution, offered by Mastercard and VISA. Merchants add a Click-to-Pay button; customers who’ve enrolled can check out in just a few clicks. New users enter their details once, and future purchases are even faster, more retyping addresses or card numbers.

While Click-to-Pay streamlines checkout, it’s not as seamless as merchant- or bank-stored tokens: customers still confirm on the card brand’s page. But it’s a leap forward in convenience and security.

Banks and PSPs can simplify Click-to-Pay integration by adding it to hosted payment pages and ensuring their plugins accept address data from card networks. Ximedes can build the integration layer you need to make Click-to-Pay effortless for your merchants.

Want to explore how Ximedes can help you lead the embedded payments revolution?

Let’s talk about your goals and how we can make seamless commerce your competitive edge.